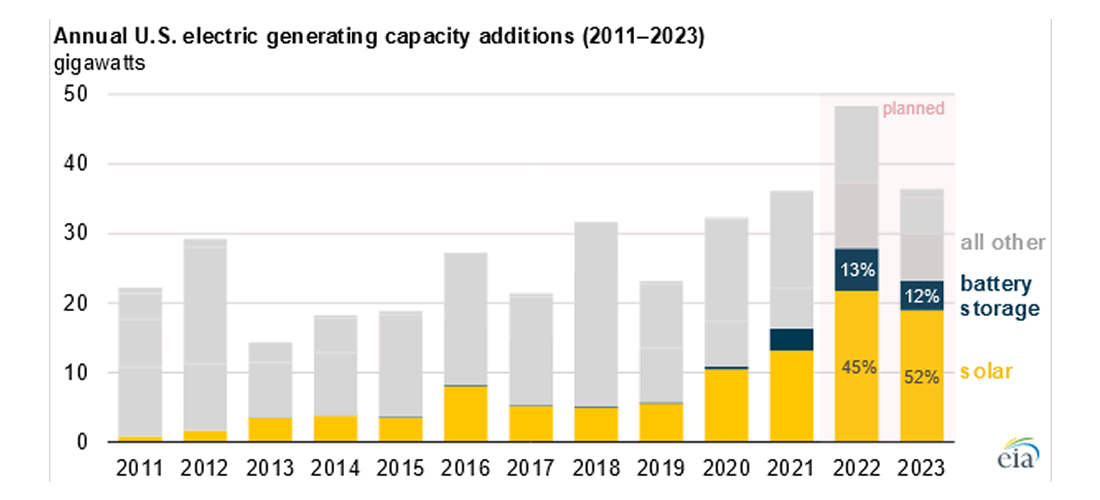

Power plant developers and operators expect to add 85 gigawatts (GW) of new generating capacity to the U.S. power grid from 2022 to 2023, 60% (51 GW) of which will be made up of solar power and battery storage projects, according to data reported in our Preliminary Monthly Electric Generator Inventory. In many cases, projects combine these technologies.

Battery storage capacity, as well as renewable capacity, significantly increased in the United States during 2021, partly because of tax credits and partly because of falling technology costs, especially for batteries. Depending on the configuration and charging sources, both solar power and battery storage units may be eligible for the solar investment tax credit (ITC), which is scheduled to phase down by 2024.

More than half of the 51 GW of planned solar and battery storage capacity within the next two years will be located in three states. The largest share, 12 GW (23%), will be in Texas. The next largest share, 11 GW (21%), will be in California, and 4 GW (7%) will be in New York.

Solar capacity. Utility-scale solar accounts for 41 GW (48%) of the planned capacity in the United States during the next two years. More utility-scale solar photovoltaic (PV) capacity was added (24 GW) to the U.S. power grid than natural gas (12 GW) between 2020 and 2021, a trend that will likely continue over the next two years as the demand for solar power continues to grow.

In 2022, power plant developers and operators expect to add 22 GW of solar capacity to the grid, significantly more than the 13 GW added in 2021. Large additions of utility-scale solar capacity are likely to continue because of falling solar technology costs and the 2020 extension of the solar ITC, which extended the credit to 26% in 2021 and 2022, 22% in 2023, and 10% in 2024 and after.

Battery storage. In the next two years, power plant developers and operators expect to add 10 GW of battery storage capacity; more than 60% of this capacity will be paired with solar facilities. In 2021, 3.1 GW of battery storage capacity was added in the United States, a 200% increase. Declining costs for battery storage applications, along with favorable economics when deployed with renewable energy (predominantly wind and solar PV), have driven the expansion of battery storage.

The remaining 34 GW of planned capacity additions over the next two years will largely come from natural gas (16 GW) and wind (15 GW). The amount of planned wind capacity dropped by nearly half from the previous two years, which had 29 GW of new wind capacity come online.

Principal contributor: Suparna Ray

Source: www.eia.gov

En

En